Usage & Attitudes Study

Understanding consumer behavior, preferences, and trends in Vietnam’s beverage market

Overview

Market Context

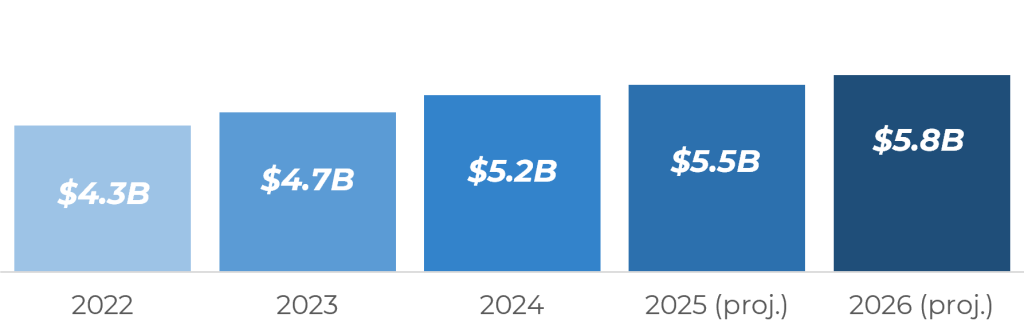

- Vietnam’s refreshment beverage market valued at approximately $5.2 billion in 2024.

- 5.8% annual growth, outpacing overall beverage sector (4.2%)

- Growing urbanization driving out-of-home consumption

- Rising health consciousness influencing product formulations

- International brands compete with increasingly sophisticated local players

- E-commerce and delivery channels creating new consumption occasions

Vietnam Refreshment Beverage Market Size

Source: Primary research/ EuroMonitor/ Nielsen, Government statistics, distributor and retailer interviews.

Research Objectives

- Analyze consumption patterns across refreshment beverage categories.

- Identify category-specific purchase drivers and barriers.

- Evaluate competitive landscape and brand performance.

- Understand consumption occasions and need states.

- Map emerging trends and innovations in the sector.